Dear readers, With the launch of e-newsletter CUHK in Focus, CUHKUPDates has retired and this site will no longer be updated. To stay abreast of the University’s latest news, please go to https://focus.cuhk.edu.hk. Thank you.

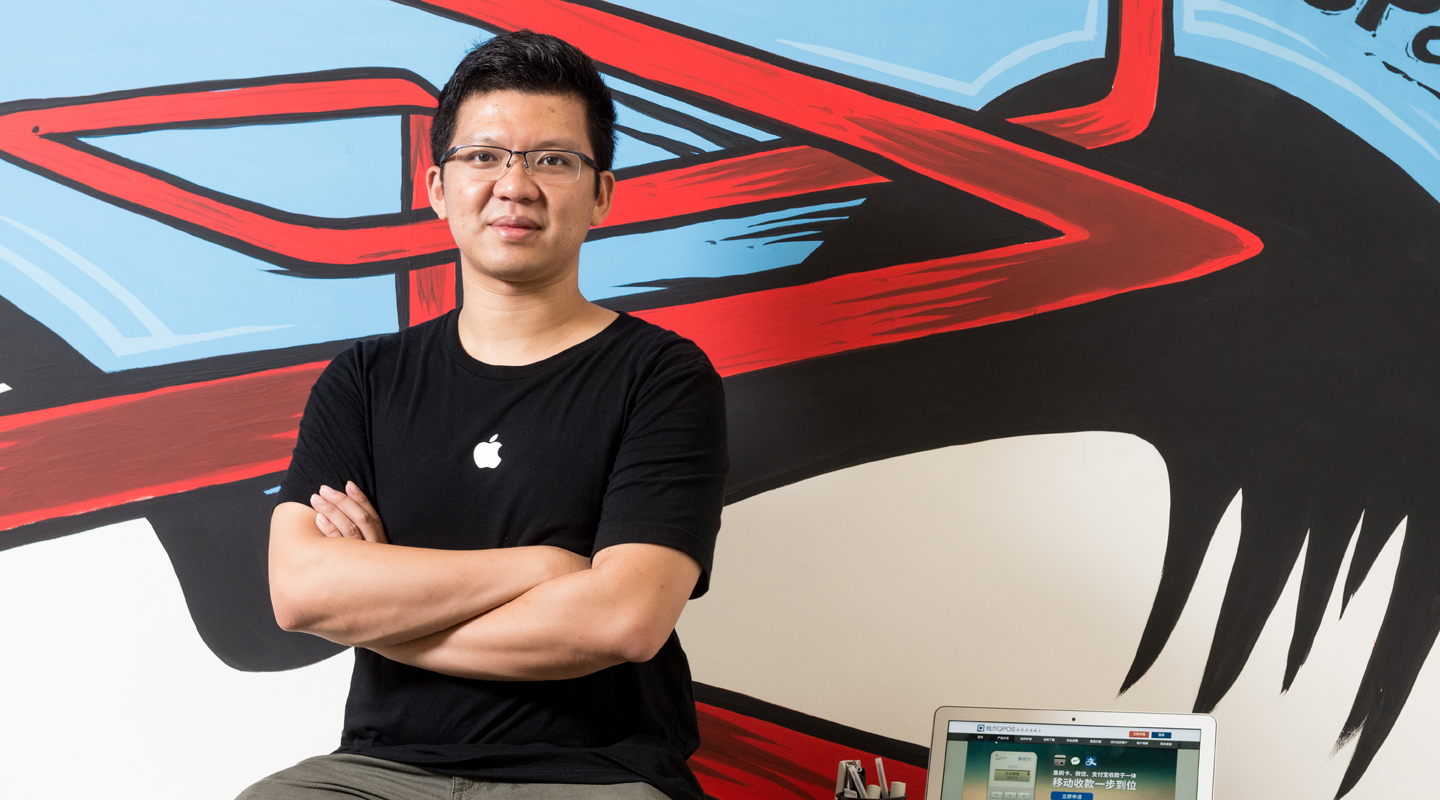

The Way to Pay: Cash, Credit Card, or your Cell? Meet Tim Lee, the brain behind the big wave of mobile payment

Information engineering alumnus Tim Lee has been the brain and driving force behind the sea change in Chinese consumer behaviour. Now he hopes to give Hong Kong's tepid mobile payment market a much-needed boost.

Tim Lee’s typical day in Beijing is like this: Hail a taxi with a taxi app to go to work. With a few taps on his cell phone, get four lattes delivered from a coffee shop downstairs to the meeting room where he is having a meeting. Scan the QR code on the bill and get 20% off his ramen lunch. Meet a new colleague back in the office and ask his secretary to, again using a cell phone, have her business cards made. Back at home, with a TV remote in his right hand, buy a plane ticket to Hong Kong the next day with his left thumb.

But make no mistake: Tim Lee is no ordinary member of Generation Y, who rely on their smartphones to satisfy all their daily needs. In fact, he has been the brain and driving force behind the sea change in Chinese consumer behaviour in recent years.

Born and bred in Hong Kong, he graduated from CUHK with an information engineering degree in 2006. In 2011, he went it alone and founded Qfpay in Beijing, eventually getting millions of small retailers all over China to embrace mobile payment as the new way to go.

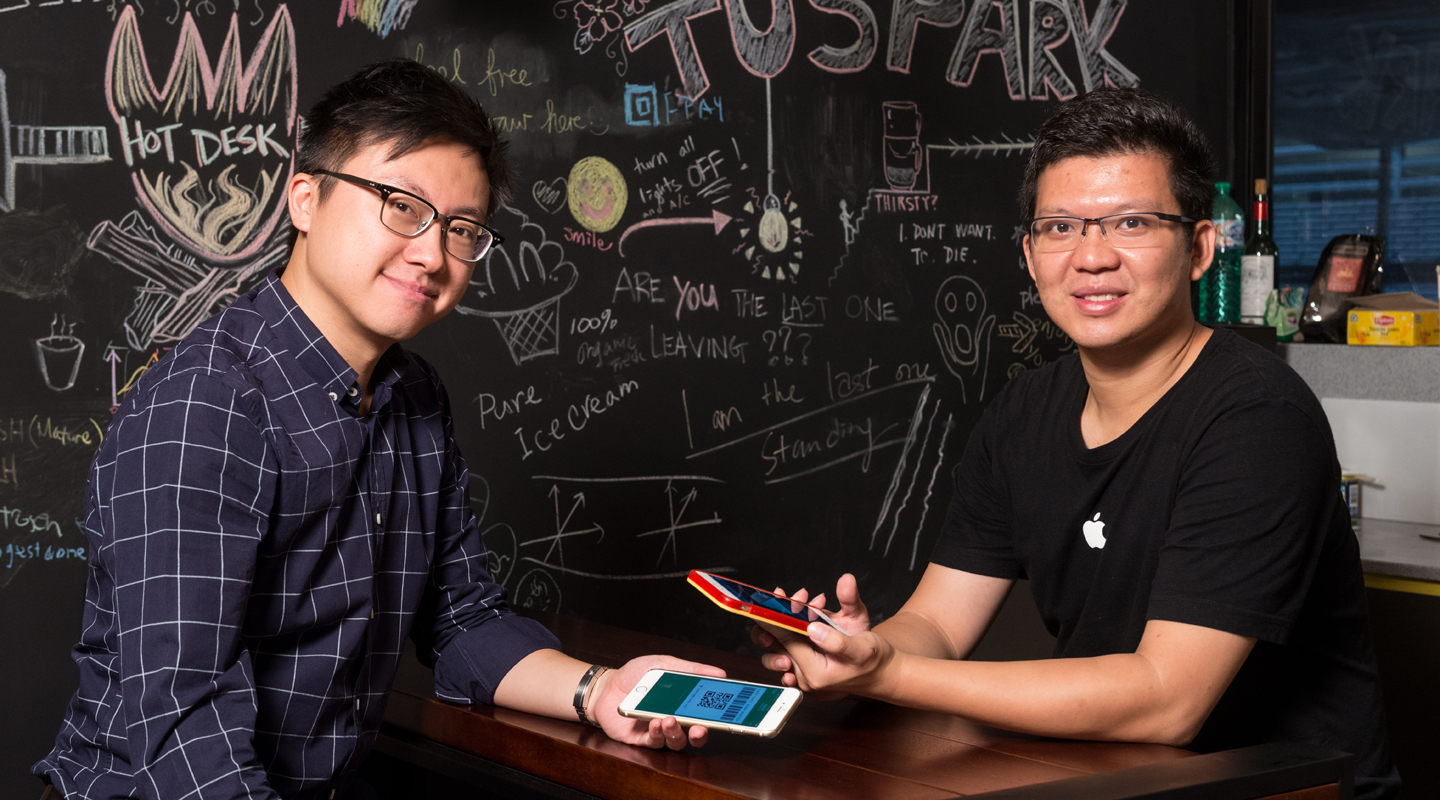

For each business transaction, a trader uses the Qfpay mobile app to generate a QR code for the payable amount. Then the payment code on the customer’s cell phone is scanned, and bingo! Payment and receipt are completed. ‘Even as digital wallets are churned out by the tech giants, it takes two hands to clap. The payment system has to be in place at the shops too.’ So this is how Qfpay works, as explained by Lee with utmost confidence.

He said while people in both Hong Kong and the mainland are inseparable from their cell phones, they do differ when it comes to digital transactions. ‘Everyone uses their phones to watch videos, play games, listen to music, and chat. But Hong Kong comes short when it comes to digital transactions. The Gen Y in the major mainland cities are so used to paying with their cell phones that they have no use for credit cards. To be honest, as far as tech applications are concerned, Hong Kong lags behind even third-tier cities across the border.’

‘As for dining guides, in Hong Kong we have OpenRice. On the mainland, they have dianping.com. The difference is, mainland customers can use the dianping app to pay for their meals. In this day and age, there is no profit to be made if an app cannot be used for business transactions. Apps for viewing only belong in the Web 1.0 graveyard.’

Actually in recent years there has been no shortage of Hong Kong telecommunications companies trying to make a foray into the mobile payment arena. Unfortunately they have not had much success so far. Launched by 3 Hong Kong only two years ago, the digital wallet using Near Field Communication (NFC) technology was already suspended in February this year. Tim made no bones about how he saw it: NFC payment is doomed to fail wherever it is launched.

‘To encourage users to link their bank cards with their cell phones, WeChat payment splashed money to lure prospective users by launching digital hongbao (red packets) among its chat groups during the Chinese New Year. By opening a WeChat payment account, customers got the chance to win a hongbao. So instead of happening overnight, mobile payment was launched below the line at the shops only after the initiation stage online. In the case of NFC, regardless of market region, trying to go below the line right from the start just won’t work.’

When asked about his marketing plans for Hong Kong, Tim said the focus would be on small businesses. ‘The jewellery and cosmetics chains have already adopted mobile payment. The cha chan tangs nearby may have been left out of the picture, and they are in no position to cut a deal with Tencent or Alibaba. But they do outnumber the jewellery stores by a long shot. So I’ll be launching Qfpay among the small businesses. On the mainland this strategy is called “encircling the cities from the countryside”,’ he laughed heartily on that note.

However, to popularize mobile payment in Hong Kong, Tim still thinks offering huge discounts the old-fashioned way is the way to go. ‘If selling a $10 pineapple bun for $5 still won’t cut it, a random $10 or up to $300 reduction for every purchase over $10 should do it, right?’

In his opinion, it is only a matter of time before cash is made obsolete. ‘In Wangjing subdistrict, where I work in Beijing, in merely one year, mobile payments already make up over 70% of overall sales in the area. Yes, things may vary greatly across the country. But it’s foreseeable that digital money will definitely take the place of cash within 10 years!’

Reported by Christine N., ISO

Photos by Cheung Wailok@Hiro Graphics

This article was originally published on CUHK Homepage in Nov 2015.