Dear readers, With the launch of e-newsletter CUHK in Focus, CUHKUPDates has retired and this site will no longer be updated. To stay abreast of the University’s latest news, please go to https://focus.cuhk.edu.hk. Thank you.

The Brand New FinTech Programme

According to the analysis of Accenture, a leading global management consulting company, financial technology (FinTech) investment in the Asia-Pacific in 2016 doubled from 2015’s US$5.2 biliion to US$11.2 billion, eclipsing North America’s US$9.2 billion in 2016.

China and Hong Kong alone accounted for US$10.2 billion, or 91%, of Asia-Pacific’s FinTech investments in 2016. In fact, all of the 10 largest FinTech investments in the Asia-Pacific last year were in China and Hong Kong, accounting for 82% of the total Asia-Pacific FinTech investment.

A Blooming Industry

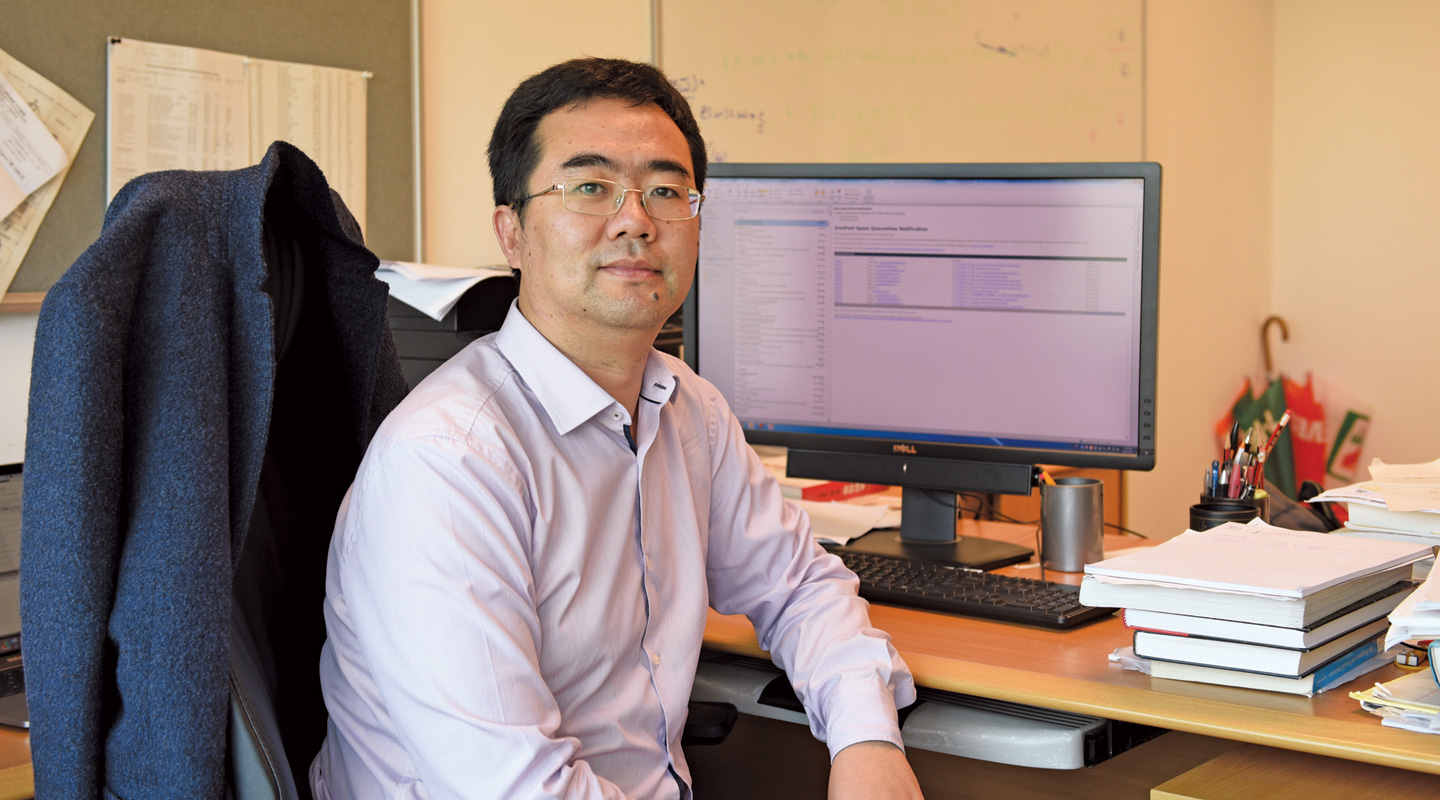

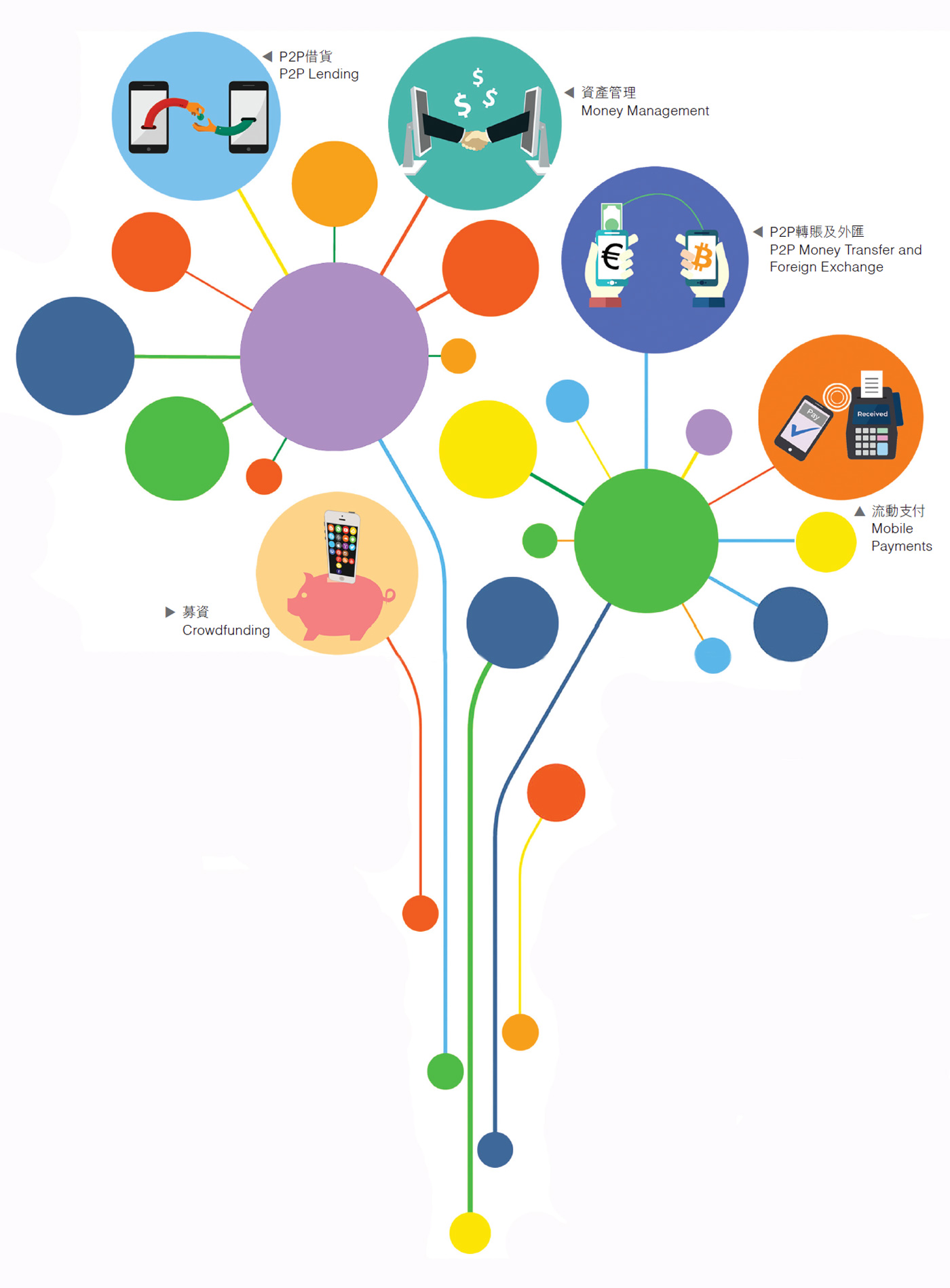

FinTech is an emerging financial industry that applies technology to improve financial activities. Prof. Chen Nan, director of CUHK’s Bachelor of Engineering Programme in Financial Technology, pointed out that FinTech demonstrates an unprecedented potential to revolutionize the traditional financial service sector, in terms of infrastructure, money management and related legal regulations.

‘Not only has the financial services sector relied more on technology to facilitate their services, there has also been a move from real “money” payment to “digital” payment. Bitcoin is a good example of the currency in the cyber world,’ explained Professor Chen. From the Octopus Card to Apple Pay, Android Pay, AlipayTMHK, WeChatPay, O!ePay, Tap&Go, etc., mobile payment is gaining popularity. Peer-to-Peer (P2P) money transfer and foreign exchange, online crowdfunding and lending platforms pose a great challenge to conventional banking services.

He went on, ‘All kinds of websites and Apps for financial planning, review, expense tracking, personal asset management and comparison of money products have mushroomed in recent years. As the industry is stretching its wings to almost every sector of financial services, concerns of personal information security, money laundering and related legal issues are raised.’

Offering Multidisciplinary Approach

To meet the high demand for FinTech professionals to cope with the exponential growth of the industry, CUHK launched the Bachelor of Engineering Programme in Financial Technology, the first of its kind in Hong Kong, this September.

Professor Chen remarked, ‘The programme aims to educate and equip students with the essential knowledge and capabilities to apply technological innovations to financial services, as well as to nurture leadership and entrepreneurship for the next generation of financial talent in support of Hong Kong’s development into an international FinTech hub.

‘We expected to admit 25 students each year. But the programme turned out to be a favourite among applicants. In the end a total of 43 new students were admitted.’

Led by the Faculty of Engineering, the FinTech programme features a strong multidisciplinary training as courses are offered by the Faculties of Business Administration, Law and Social Science. Students are able to acquire cutting-edge technical skills and a broad understanding of the potential legal, economic and societal impacts of financial technology.

To ensure new students adapt and thrive, major foundation courses such as engineering design, programming, business finance, microeconomics and cyber security, will be offered in the first two years of their studies to introduce some basic information on the subject. Apart from focusing on the study of FinTech, students also enjoy the freedom to enroll in a minor programme offered by any Faculty or Department at CUHK according to their interests. ‘Two professors of practice have been appointed to introduce practical experience to students,’ added Professor Chen.

Forging a Strategic Partnership

The programme collaborates closely with the Hong Kong Monetary Authority (HKMA) and the Hong Kong Applied Science and Technology Research Institute (ASTRI) to offer internship and overseas exchange opportunities for its students. It is also actively seeking collaboration opportunities with Cyper Port, Hong Kong Science and Technology Parks Corporation and other private companies to organize FinTech-specific internships. Students can also join the Placement and Internship Programme (PIP) centralized by the Faculty of Engineering for a variety of opportunities for work-study, long-term or short-term internships and student exchange.

Way Ahead

The second annual Hong Kong Fintech Week organized by ‘Invest Hong Kong’ will be held from 23 to 27 October at the Hong Kong Convention and Exhibition Centre. This year the event will focus on the driving forces that shape Hong Kong as a global FinTech hub.

Professor Chen said, ‘The Hong Kong government regards FinTech as one of its main strategies to maintain the competitiveness of the local financial industry and also encourages FinTech talent in Hong Kong to set the standards for the latest financial technologies within the region. The employment opportunities for innovative young talent who are trained in this specific field are thus abundant.’

Graduates of the FinTech programme will be ideally suited for positions that require strong quantitative and technological skills in the financial services industry. Prospective career opportunities include investment and commercial banking, insurance, asset management, internet finance, government regulatory agencies and FinTech startups. They can also pursue further studies in finance, management sciences and engineering, computer sciences, information engineering and other related fields.

This article was originally published in No. 505, Newsletter in Oct 2017.